In addition to growing their platform companies via bolt-on acquisitions, most PE firms will also seek to juice up internal performance and organic growth. Many funds will professionalize the new platform company with an upgrade to the accounting system and improved reporting standards. Critical to growth, funds will judiciously water the company with new capital equipment investments that are needed. Private equity will bring a disciplined and structured approach to the management of the operations.

Some private equity firms have a long-term vision, a build-and-hold strategy; however, that is the exception. Most have obtained their funding from limited partners to whom they have committed a return of the initial investment plus a superior return, all within a predetermined time frame. With the clock ticking on when the return of capital is required, the funds eventually must find a buyer and exit their investment. Hence, we see secondary, and even tertiary, buyouts, in which one fund sells its platform company to another private equity fund. The process begins anew, and the roll-up continues.

PE Fed and Watered Packaging Roll-Ups in 2022

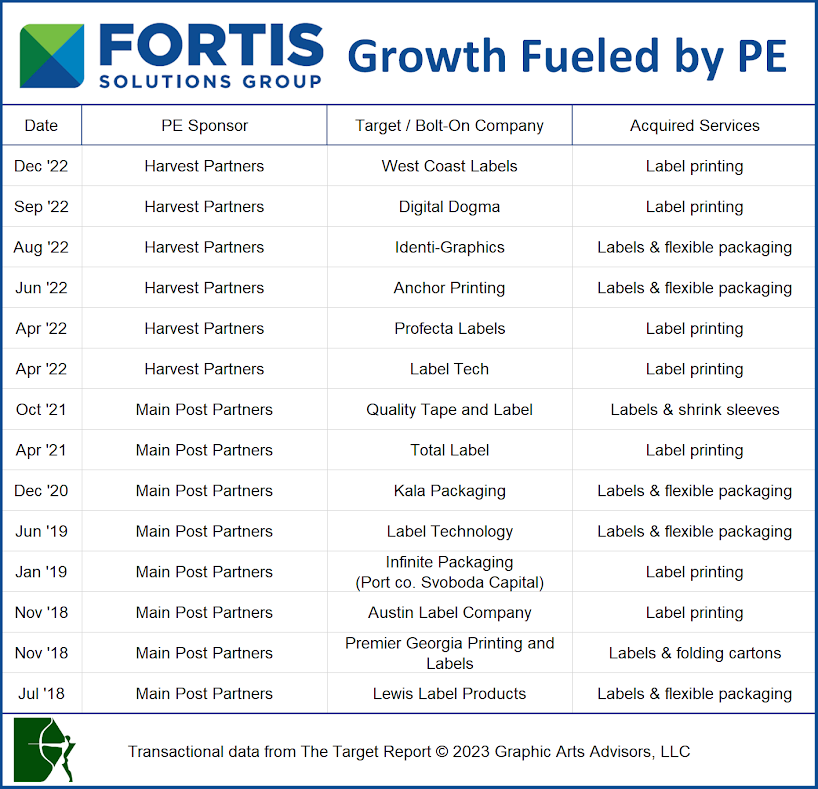

Fortis Solutions Group is an excellent example of a packaging company that has executed a strategic growth plan with private equity backing. One of the most active private equity-backed roll-ups in the label printing segment, and now with its secondary sponsor, Fortis recently acquired West Coast Labels, located in Placentia, California. This was the sixth acquisition in 2022 by Fortis of a label printing company, building on their “One Fortis” strategy. Investment banker John Wynne started Fortis in 2010 with the purchase of Labels Unlimited, a one-location company in Virginia Beach focused solely on pressure sensitive label production. That was when the country was recovering from the Great Recession. Fortis now has twenty-two manufacturing sites across the US and employs over 1,300 people.

After an initial growth spurt that included the acquisition of several geographically diverse label printing companies, Fortis partnered with San Francisco-based Main Post Capital Partners in 2017. Main Post Capital Partners supercharged the next phase and Fortis acquired no less than eight additional companies in just under four years. One of those acquisitions, the purchase of Infinity Packaging, was itself a secondary buyout of a small label roll-up put together by Svoboda Capital. In October 2021, Main Post Capital Partners announced that it had exited Fortis, selling its interest in a secondary buyout to Harvest Partners, a private equity fund based in New York. Harvest hit the road running and provided support for the six companies added to the Fortis platform in 2022.

Wynne’s entry into the packaging business is not the typical story of a bootstrap startup or next generation succession into the family business. He did not have any prior printing or packaging experience but was attracted to the custom manufacturing nature of the business, as well as the ability for a small company in the label industry to focus on serving national brands. Wynne’s entry into the packaging industry as an outsider represents an example of a trend that we currently see reemerging in the post-pandemic period; professional executives from outside the industry seeking to acquire a modest size manufacturing company they can own and build upon. (Notably, other segments of the printing industry, including commercial printing, are not excluded from this renewed interest from outsiders.)

Fortis is not the only packaging platform company that has been supercharged by private equity. As we have noted in several Target Reports over the past several years, private equity interest in the package printing business has lifted multiples and provided a very healthy exit for many owners of label printing, flexible packaging, and related companies. In 2022, we identified forty-four transactions in packaging in which the buyer was backed by private equity. Several of the buyers, like Fortis, were serial acquirers and completed several deals during the year. All told, we noted nineteen distinct private equity firms that supported their existing packaging platform companies with new acquisitions in the past twelve months. In addition, six new packaging platforms were acquired by private equity in 2022, setting the stage for M&A activity to remain robust in the packaging segments.

Commercial Printing Receives PE Love in 2022

While not attracting anywhere near the level of attention as the packaging companies, the other print-related segments are now in the sights of some private equity firms. Investments in printing companies have been across a wide spectrum of specialties, including direct mail, consumer products, wide-format, and in a notable return to grace within the investment community, private equity investments now include general commercial printing companies.

The best example of this interest from private equity may be the investment by Snow Peak Capital, a fund based in Boulder, Colorado, which acquired a majority interest in Sandy Alexander, the venerable commercial printing company headquartered in Clifton, New Jersey. Working with existing management, Snow Peak indicated that its financial support would be utilized to improve company operations and margins, and explicitly would include growth by acquisition. No bolt-on acquisitions have been publicly announced yet in the eight months since the initial investment in the Sandy platform, but with new equity funding in place, we expect deals will be forthcoming.

Sandy has been down the private equity road before. Well before private equity was a major asset class and generally known as a force in the economy, Sandy had institutional investors. That relationship with an investment firm stood out at the time because most printing companies were either privately owned, or publicly traded.

Founded in 1963 as Alexander & Son, the company grew by acquisition and in 1969 merged with Sandy Printing to form the Sandy Alexander brand that still exists to this day. In 1972 Sandy Alexander was acquired by the Mickelberry Food Corporation, a public company that traced its roots back to 1926 and was originally in the processed meats business. As Mad Men fever gripped the business community in New York, Mickelberry joined in and acquired several well-known advertising agencies, some of which served clients in the grocery business. The advertising business led Mickelberry to acquire assets in the printing business, including Sandy Alexander, Carnival Press, and other printing interests.

In 1975, Sandy Alexander and Carnival Press were merged, and more acquisitions followed. By 1980 Mickelberry had become primarily an advertising and printing company; the revenues from these services then collectively represented three quarters of total company revenues. This was a prestigious time for Mickelberry. Listed on the New York Stock Exchange, no less a personage than Franklin D. Roosevelt Jr., son of the former president, chaired the company’s executive committee at the time of his death in 1988.

Under the auspices of the rebranded Mickelberry Corporation, Sandy acquired the sales of Americom In 1991, bringing current CEO Mike Graff into the organization. Rebranded once again, Mickelberry Communications was taken private in 1995 by Union Capital, a private equity fund founded by high-society attorney and businessman James Marlas. Married from 1984 to 1987 to actress Glenn Close, Marlas served on the boards of the New York City Opera, a college charitable foundation, and the French wine lovers association Commanderie de Bordeaux. Heady times in the printing industry, to be sure.

In July 2013, the Sandy Alexander management team bought out the PE backers and, until this past year, the company was exclusively owned by that management team. With the sale this past year to Snow Peak Capital, Sandy Alexander reenters the private equity world, possibly more staid than the first go round, but ready to begin the next phase of a long and storied history. Acquisitions are sure to follow.

Sandy Alexander is not the only commercial printing company that appears ready to be supercharged by private equity. In 2022, Post Capital Partners acquired Ironmark, a diversified commercial printing company in Maryland. Soon after it was established as a platform company, Ironmark completed its first bolt-on, the acquisition of Millennium Marketing Solutions.* More will surely follow.

Arizona-based commercial printing company Prisma Graphic received backing from CenterGate Capital in 2022. Prisma had already begun its expansion program, prior to the entry of private equity, with the acquisition of two companies in 2021 in Nashville, Tennessee. The CEO of Prisma noted that CenterGate’s investment provides the company with the capital to further expand the Prisma platform. More acquisitions will follow.

In total, in the 2022 Target Reports, we identified six transactions in the commercial printing segment in which the buyer was backed by private equity. Two buyers, JAL Equity and Revitalize Capital, are serial acquirers and completed bolt-on deals during the year. Despite the renewed interest in commercial printing by the professional investment community, we do not expect a return to the go-go deal activity that commercial printing experienced in the 1990’s. However, with the establishment of three new significant PE-backed platform companies, accompanied by the continued appetite for new deals from the existing PE-backed companies, the exit potential for commercial printing company owners is brighter than it has been for years.

* Graphic Arts Advisors, publisher of The Target Report, served as exclusive advisors to Millennium Marketing Solutions in this transaction.

| 2022 December - Mergers and Acquisitions in the Printing, Packaging, Paper & Related Industries | |||||||||||||

Deal Party #1 (Surviving Entity) |

Pre-Deal Revenue (US$Mil) |

Party #1 Address |

Deal Party #2 |

Pre-Deal Revenue (US$Mil) |

Party #2 Address |

Date Deal Public |

Deal Value (US$Mil) |

Deal Structure (Intermediary) |

Notes |

Link | |||

| GSG | No Data | Dallas, TX | Montroy Denver (Div. Montroy Sign & Graphic Products) |

No Data | Signal Hill, CA | 12/29/22 | No Data | Acquisition | Graphic supplies distributor | Link | |||

| Fortis Solutions Group (Port co. Harvest Partners) |

No Data | Virginia Beach, VA | West Coast Labels | No Data | Placentia, CA | 12/15/22 | No Data | Acquisition | Label printing | Link | |||

| Color Ink | No Data | Sussex, WI | HM Graphics | No Data | Milwaukee, WI | 12/12/22 | No Data | Acquisition | Commercial printing | Link | |||

| Multi-Color Corporation (Port co. Clayton, Dubilier & Rice) |

No Data | Cincinnati, OH | Lux Global Label | No Data | Lafayette Hill, PA | 12/12/22 | No Data | Acquisition | Label printing | Link | |||

| QDPP&E/AAA Press International | No Data | Egg Harbor, NJ | Table Top Rewinder Division (Div. Lederle) |

No Data | Pacific, MO | 12/8/22 | No Data | Asset Acquisition | Flexo finishing equipment | Link | |||

| Phoenix Innovate | No Data | Troy, MI | UN Communications Group | No Data | Carmel, IN | 12/7/22 | No Data | Acquisition | Commercial printing | Link | |||

| UFP Packaging (Div. UFP Industries) |

$9,730 | Grand Rapids, MI | Titan Corrugated | $46.5 | Flower Mound, TX | 12/6/22 | No Data | Acquisition | Corrugated boxes | Link | |||

| ImageMark Mngt Team | No Data | Gastonia, NC | ImageMark Business Services | No Data | Gastonia, NC | 12/6/22 | No Data | Mngt. Buyout | Commercial printing | Link | |||

| Burlington Multimedia (Affil. Community Media Group) |

No Data | West Frankfort, IL | The Burlington Hawk Eye (Prop. Gannett) |

No Data | Burlington, IA | 12/6/22 | No Data | Acquisition (Dirks, Van Essen) |

Community newspapers | Link | |||

| Lachemont Group | No Data | South Plainfield, NJ | Coastal Packaging | No Data | Houston, TX | 12/5/22 | No Data | Acquisition (Benchmark) |

Bags & packaging films | Link | |||

| Engine Vision Media | No Data | Los Angeles, CA | Los Angeles Magazine (3 titles) (Prop. Hour Media) |

No Data | Irvine, CA | 12/5/22 | No Data | Acquisition (Diamond Capital) |

Magazine publishing | Link | |||

| BR Printers | No Data | San Jose, CA | Ross4Marketing | No Data | Denver, CO | 12/5/22 | No Data | Acquisition | Commercial printing | Link | |||

| I.D. Images (Port co. Sole Source Capital) |

No Data | Brunswick, OH | Precision Label | No Data | Calgary, AB | 12/5/22 | No Data | Acquisition | Label printing | Link | |||

| I.D. Images (Port co. Sole Source Capital) |

No Data | Brunswick, OH | Summit Labels | No Data | Port Coquitlam, BC | 12/5/22 | No Data | Acquisition | Label printing | Link | |||

| WhatTheyThink | No Data | St. Paul, MN | Inkjet Insight | No Data | St. Paul, MN | 12/1/22 | No Data | Acquisition | Industry publication | Link | |||

| 2022 December - Bankruptcy Filings in the Printing, Packaging, Paper & Related Industries | ||||||||||||

Filing Party |

Date Case Filed |

Pre-Petition Revenue (US$Mil) |

Case # |

Filing Party Address |

Circuit |

Region & City |

Judge |

Attorney for Debtor |

Notes |

|||

| Chapter 11 Filings: | ||||||||||||

| DCL Corporation (USA) LLC (Port co H.I.G. Capital) |

12/20/22 | No Data | 22-11323 | Toronto, ON | 3rd | Delaware Wilmington |

J. Kate Stickles | Amanda R. Steele | Pigment manufacturing | |||

| Chapter 7 Filings: | ||||||||||||

| Printing House LLC | 12/9/22 | No Data | 22-13311 | Philadelphia, PA | 3rd | Eastern PA Philadelphia |

Magdeline D. Coleman | Michael A. Cibik | Printing & copying | |||

| 2022 December - Non-Bankruptcy Closures in the Printing, Packaging, Paper & Related Industries | |||||||||||

Closed Company / Facility |

Date of Closure |

Pre-Closure Revenue (US$Mil) |

Closing Address |

Related Party | Related Party Address |

Date Closure Public | Notes |

Press Releases |

|||

| No Plant Closures Found this Month | --- | --- | --- | --- | --- | --- | --- | --- | |||